Company overview

- Company name

- MINAMIAOYAMA REAL ESTATE Inc.

- Date of Establishment

- June, 2010

- Capital

- 30 million yen

- Representative Director

- Ryo Tabata

- Website URL

-

-

- Japanese

- https://www.ma-r.co.jp/

-

- English

- https://www.ma-r.co.jp/en/

-

- Chinese (traditional characters)

- https://www.ma-r.co.jp/zh-tw/

-

- Chinese (Simplified characters)

- https://www.ma-r.co.jp/zh-cn/

-

- License number

-

-

- License certificate number of real estate broker

-

- The Minister of Land, Infrastructure, Transport and Tourism (1) No.10931

-

- Office of a first class architect

- Tokyo Governor Registration No. 62450

-

- Special Construction License

- License from Governor of Tokyo(special construction business -3) No.154079

-

- Rental Housing Property Management Agency

- The Minister of Land, Infrastructure, Transport and Tourism (1) No.003592

-

- Condominium Management Agency

- The Minister of Land, Infrastructure, Transport and Tourism (1) No.034578

-

- Housing accommodation management company

- Minister of Land, Infrastructure, Transport and Tourism(01) No.F00844

-

- Housing accommodation brokerage company

- Commissioner of the Japan Tourism Agency(01) No.S0051

-

- Secondhand Articles Business Permission

-

-

- Tokyo Metropolitan Public Safety Commission

- No. 301122220036

-

- Name of Secondhand Articles Business:

- Minami Aoyama Real Estate Inc.

-

- Affiliated organization

- All Japan Real Estate Association, (General Incorporated Association) Tokyo Real Estate Association, Real Estate Guarantee Association, Japan Inspection Organization (JIO) Existing Housing Property Defect Insurance, All Japan Real Estate Political Federation Tokyo, Tokyo Chamber of Commerce and Industry C2414562, (General Incorporated Association) Minpaku & Minshuku Association, Aoyama Omotesando Store Society, (Public Interest Incorporated Association) Azabu Corporate Association, Konnoh Hachimangu Shrine Parishioners

- Our business

- Buying and sales of property, property brokerage (leasing and sales), property management, architectural design, consulting, inns and residential accommodation, food and drink, storage rooms, translation and interpretation.

- Correspondent financial institutions

- Asuka Shinkumi Bank, Kagawa Bank, Sawayaka Shinkin Bank, Shizuoka Bank, Shiba Shinkin Bank, Shonan Shinkin Bank, Johoku Shinkin Bank, SURUGA Bank, Seibu Shinkin Bank, Tokyo City Shinkin Bank, Tokyo Star Bank, Tokyo Higashi Shinkin Bank, Towa Bank, Higashi Nippon Bank, Mizuho Bank, Sumitomo Mitsui Banking Corporation, MUFG Bank, Musashino Bank, Resona Bank, SBJ Bank

(In the order of the Japanese syllabary)

Access

Tokyo Head Office

- FARO Minamiaoyama, 3F, 6-7-7 Minamiaoyama, Minato Ward, Tokyo 107-0062

- TEL:+81-3-6427-3156FAX:+81-3-6427-3157

- Access:

12-minutes walk from Omotesando St. of Tokyo Metro Ginza Line

17-minutes walk from Hiroo St. of Tokyo Metro Hibiya Line

Kyoto Branch

- Room 802, Miyako Bldg., 546 Nijoden-cho, Karasuma-dori Oike-agaru, Nakagyo-ku, Kyoto-city, Kyoto

- TEL:+81-75-585-5378

- Access:

2 minutes walk from Karasuma Oike Station, Tozai Subway Line

Group Company Information

Tokyo Minami-Aoyama Real Estate Co., Ltd. (Taiwan Local Subsidiary)

- Kaohsiung Office

- No.253,Meishu E.2nd Rd.,Gushan Dist,Kaohsiung City, Taiwan

- TEL:+886-7522-3077FAX:+886-7-522-7585

- Access:

4-minutes walk from Meishu dong si lukou bus stop, you can ride on the bus from Kaohsiung Arena metro St of Kaohsiung MRT

- Taipei Office

- 191 North Road, Songshan District, Taipei, 8 ro -2

- Access: 7 minutes walk from Nanjing Reconstruction Station on the Wenhu Line and the Songshan Line

7 minutes walk from Nanjing Reconstruction Station on the Wenhu Line and the Songshan Line on the Taipei MRT

Tokyo Minami Aoyama Investment Management Co., Ltd.

(Hong Kong Local Subsidiary)

- Room 507, 4/F., Lee Garden Three, 1 Sunning Road, Causeway Bay, Hong Kong

- TEL:+852-3769-6099

- Access:A 5-minute walk from Causeway Bay MTR St. (Exit F1)

Business performance

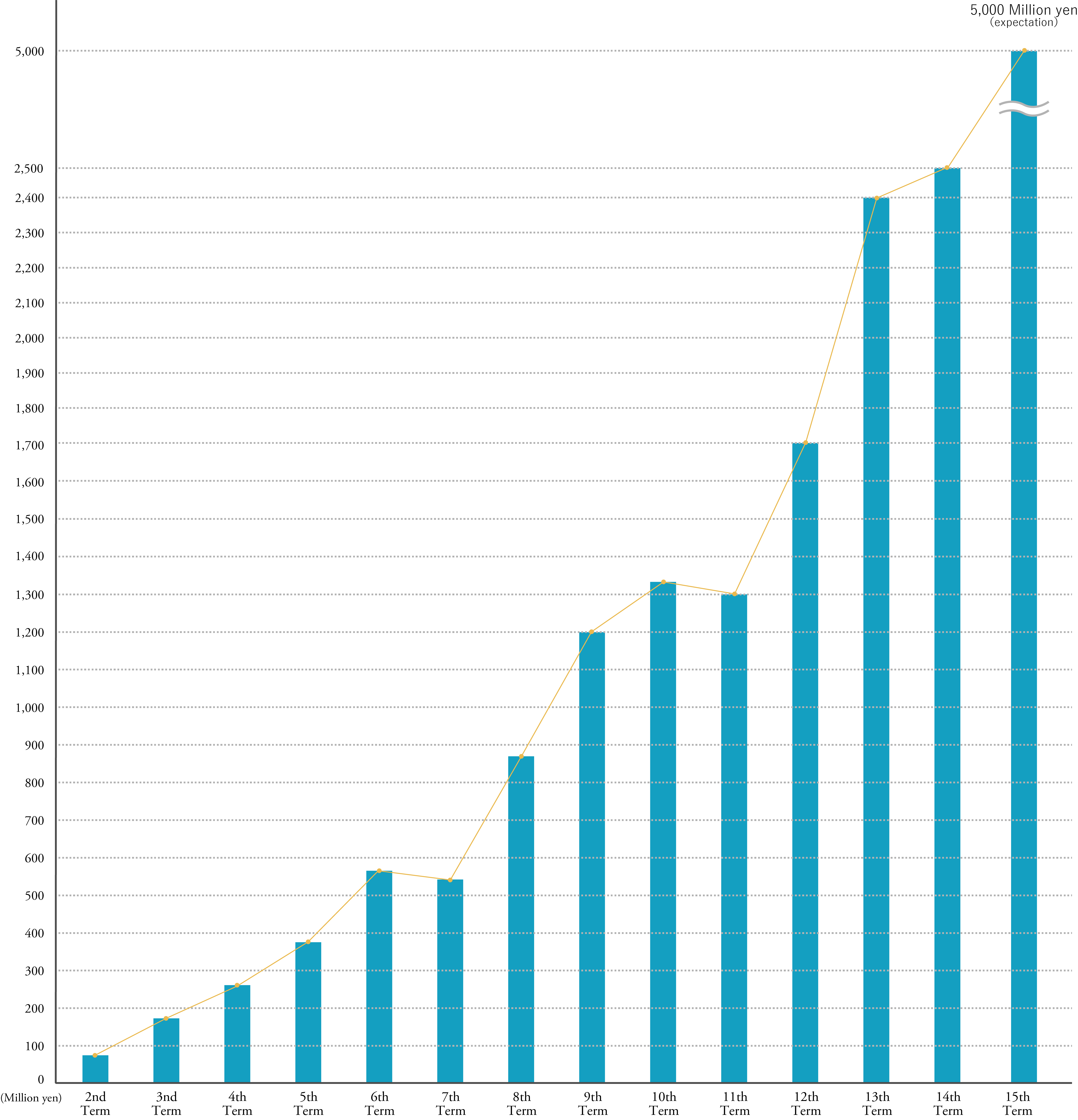

Annual sales

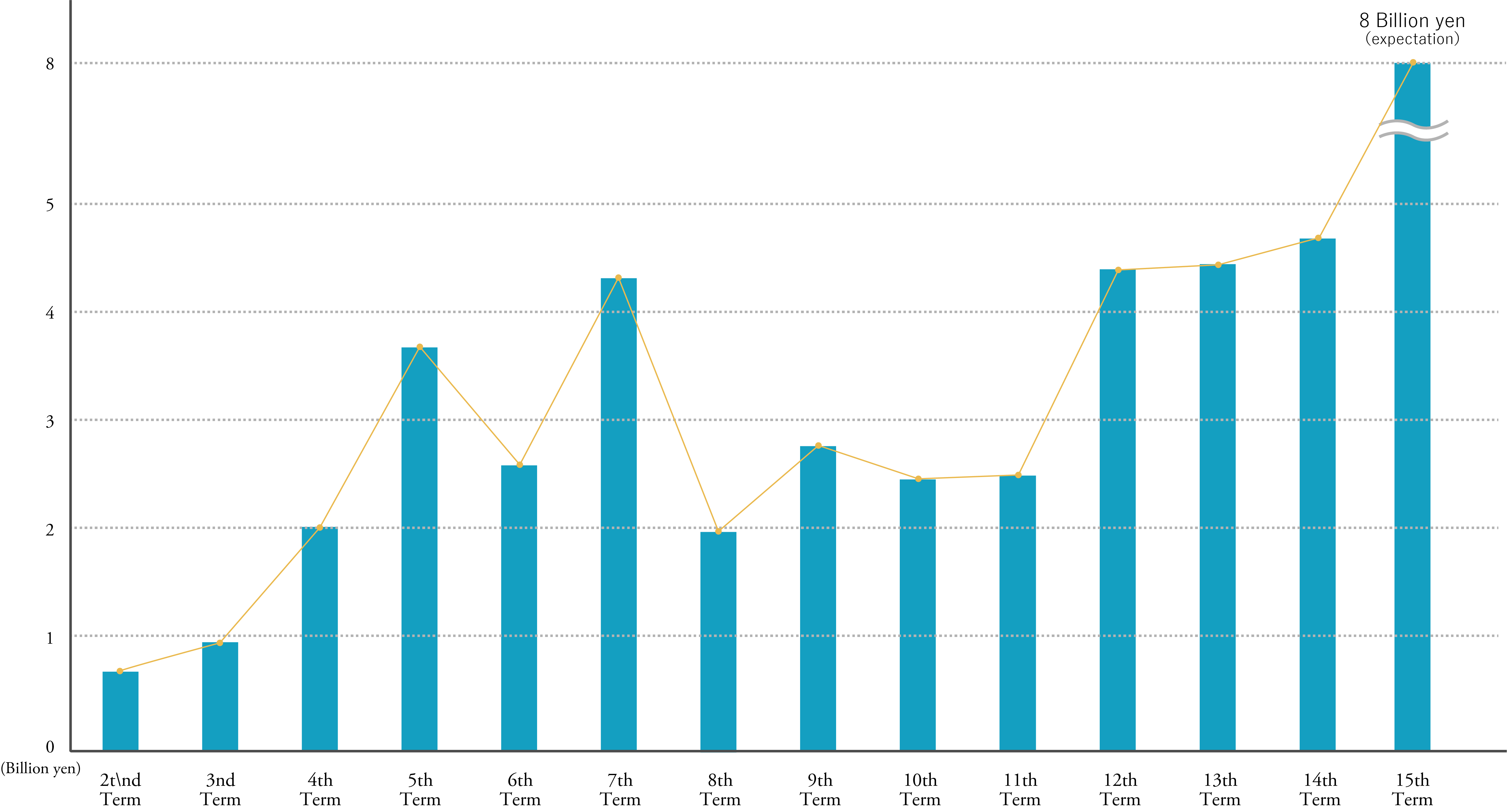

Annual Brokerage Transaction Volume

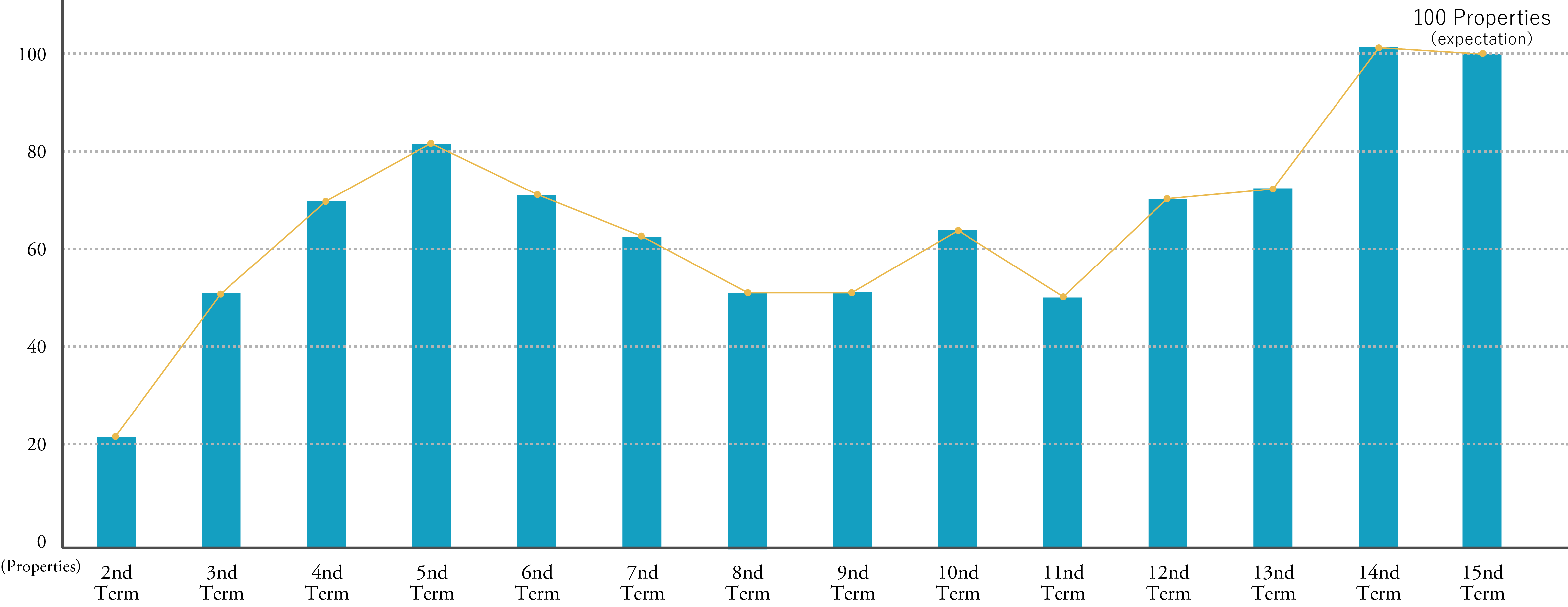

Annual amount of properties handled

In the 15th fiscal period (October 2024), thanks to our ongoing efforts in branding and diversification strategies, MinamiAoyama Real Estate Inc. experienced a significant surge in both revenue and profits.

Looking ahead to the 16th period (October 2025), we anticipate further substantial growth driven by our core business, the "Maximization of Negative Real Estate Values." This period will also see the launch of our global real estate property search platform and a dedicated negative asset acquisition platform, positioning us for continued revenue and profit growth in the 16th period.

Labeling in accordance with the

Secondhand Articles Business Act