Loan Consultation

Loan Consultation

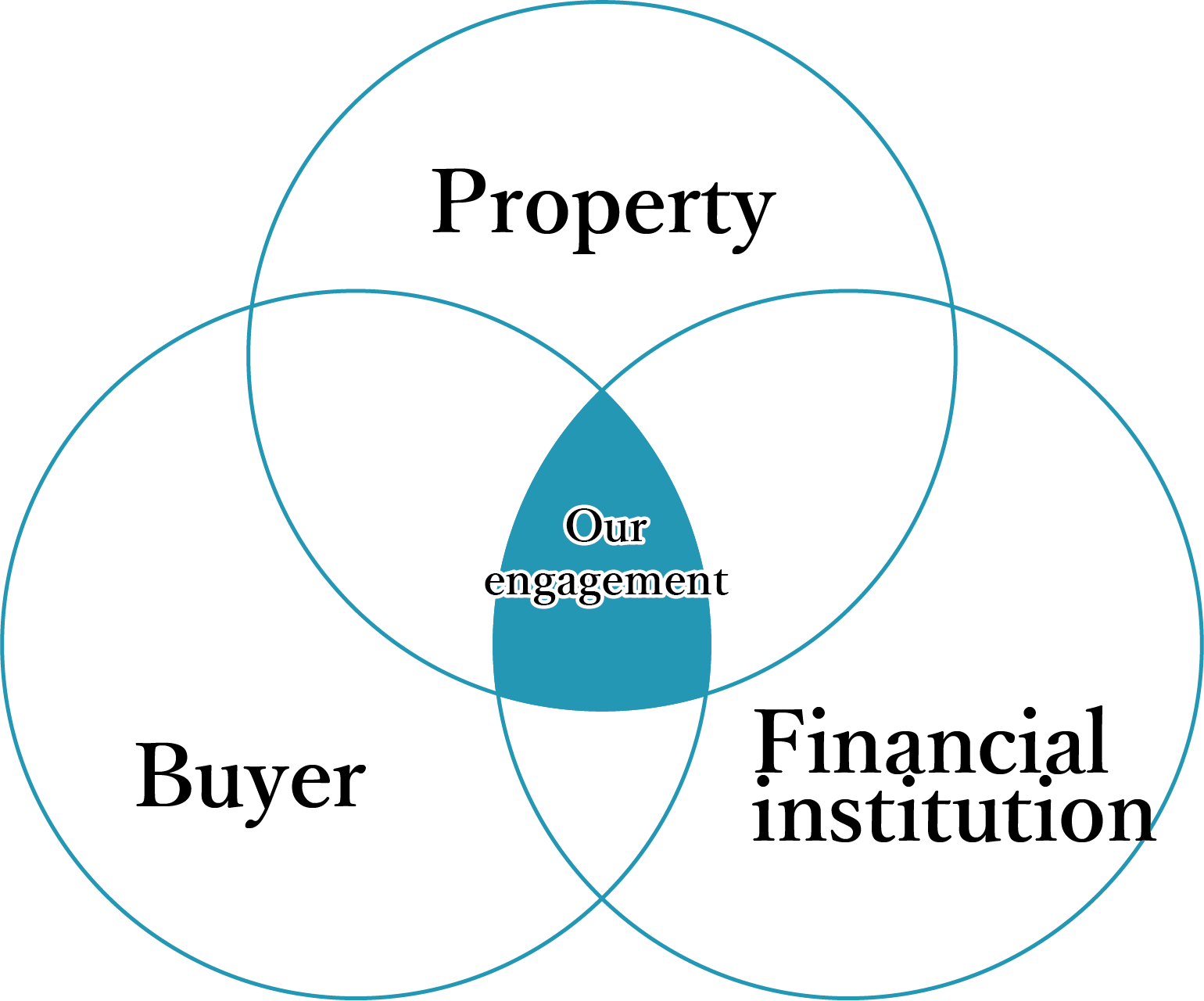

We can offer you the best "loan proposal".

First, please tell us about your preferences and status.

If you say "real estate collateral financing", there are many different financial institutions that funds loan, and each has its own unique characteristics.

We have a past performance record of handling all real estate issues, so we know the latest trends in financing for various kinds of property.

We will ask you carefully about your wishes, circumstances, questions and concerns. Feel free to contact us for anything you would like to know.

Offer the best plan for buyers

Individual customers:

- Would like to know how much loan you can get in your current status

- Would like to receive a mortgage in a favorable conditions

- Would like to receive a loan for self-fund 0 ¥

- Would like to receive an internet-based mortgage, but you worry if you can do it yourself

- Would like to move to a new house despite mortgage is left

- Would like to receive a loan although you lives in a country other than Japan

- Would like to receive a loan for a second house / a summer house purchases

- Would like to receive a loan for real estate investment

- Would like to know about the real estate investment in general

- Would like to receive a loan although do not have a permanent residency

- Was declined after consulting with another company but still would like to receive a loan

- Would like to receive a loan for a reform and other expenses

Past performance

35-year-old male, corporate employee, annual 5 million ¥ income,

- purchased property

- Apartment in Minato-ward with 80 million ¥

- Consultation contents

- Do not have a permanent residency and failed on screening process

- Our proposal

- Drafted a long-term settlement plan, clarification of assets held, negotiation with financial institutions, etc.

- Result

- Qualified a screening process and received loan amount 20 million ¥ for repayment period of 35 years with an interest rate of 1.9%

Corporate customers

- Would like to know the financing information of the bank other from the existing business partner.

- Would like to receive a loan although the period of business years(records) is short.

- Would like to receive a loan despite the fact that the business outcome is getting worse.

- Would like to talk about the whole project including financing.

Past performance

"A" Corporation (construction industry), 2 years of business history, Capital 5 million ¥,

- Purchased property:

- whole-profit building in Shibuya-ward, for the price of 〇 million ¥

- Consultation contents

- Financeable amount was low due to lack of the business performance and couldn’t purchase desired property.

- Our proposal

- for low loan potential due to lack of performance, no purchase of desired property: Reviewing the financial plan, drafted documents like peripheral contract cases etc., and proposed a way to reduce the business running costs

- Result

- Qualified a screening process and received loan amount of 80 million ¥ for the repayment period of 20 years with an interest rate of 1.8%

Please contact us regarding real estate

that falls under the following conditions as well

- Aging property with a significant time since its construction

- A lease hold buildings

- Narrow land / Deformed land

- Other discounted property (building with multiple buildings, property with past incidents etc.)

- Former earthquake-proof buildings

- Non-rebuildable property

- The property with a violation of building-to-land ratio or floor area ratio etc.

©MinamiAoyamaRealEstate Inc.

Labeling in accordance with the

Secondhand Articles Business Act